Provide global customers with the best e-liquid & nic salt & free base and the best service, all in Vape Hammer.

Tobacco tax now applies to e-cigarettes By when do liquids without a tax stamp have to be sold off?2023-03-13

On December 28, 2022, the German Customs sent a letter to inform the local e-cigarette associations and economic operators to re-tax tobacco product substitutes (that is, "e-cigarettes") that were launched before July 1, 2022: the requirements were not fulfilled The e-cigarettes that are obligated to pay taxes are returned to the tax warehouse, and those who have the right to obtain tax stamps (manufacturers, importers, or buyers for commercial purposes) will stamp tax stamps to fulfill the obligation of retroactive tax collection.

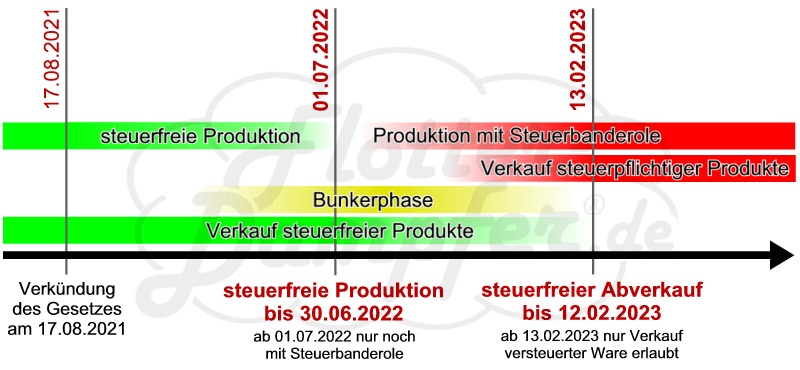

By when do liquids without tax stamps have to be sold? Everything that was manufactured/imported before July 1st, 2022 can be sold without a tax stamp. However, there is a transition period until February 12th, 2023, so that before July 1st manufactured liquids can still be sold without the new tax until then. On February 13, 2023, no more untaxed goods may be on the shelves.

The time has come, from July 1, 2022, a tax will also be due on Eliquids in e-cigarettes. The new tobacco tax has been in effect since the beginning of the year. It was decided in August 2021. According to the new "Tobacco Tax Modernization Act" (TabStMoG for short), the tax on these stimulants is now increasing every year. And tobacco substitute products such as e-cigarettes will also be subject to the new taxation in the second half of 2022. Now, is that a reason for you to quit smoking?

Stock purchases and illegal alternatives In the last few months in particular, many e-cigarette users have therefore hoarded something. Don't worry, the vaporization products are not sold out yet. Experts expect that the sellers' warehouses will be well stocked until the beginning of 2023. Then more and more often you only find liquids with the tax stamp - this is already known from cigarette packs. The Industry Alliance for Tobacco-Free Enjoyment (BFTG) criticizes – for several reasons. Because the tobacco tax for e-cigarettes is not calculated according to the amount of nicotine, but purely on the volume (milliliter) of the product. In addition, the tax increase not only affects liquids, but all products that are "smoked" in a vaporizer. So I ask myself: So also propylene glycol (PG), glycerin (VG) and flavorings? Exactly! But only if consumers buy them in a vape shop. In the pharmacy, for example, no tax is due on the individual ingredients. Therefore, the black market for e-cigarette liquids could become large. "E-cigarette users may be tempted to buy these ingredients cheaply and then mix them themselves," says BFTG Chairman Dustin Dahlmann.

Constitutional complaint against tax increase The alliance already filed a constitutional complaint with the Federal Court of Justice in June. Now non-smokers could say: "Why? Serves the quartz ends right.” But one main point against the renewed financing of the federal budget via the tax on luxury foods is somehow understandable. Products such as glycerine or flavorings are part of e-cigarettes, but they do not contain any nicotine themselves. However, the outcome of this complaint is still a bit of a wait. Let's see what else happens there.

Electric cigarette 10 milliliters 1.60 euros

control characters In contrast to other types of excise duty, tobacco tax is paid using German tax stamps (colloquially known as "banderoles") (§ 17 TabStG). "Use" means the attachment of the tax stamps to the retail packaging; they are to be attached in such a way that the tobacco products cannot be removed without visible damage to the tax stamp or the pack and the tax stamp cannot be detached without being damaged. The manufacturer or the importer has to order the tax stamps according to the officially prescribed form and calculate the tax stamp liability himself. The tax character debt then arises with the reference to the tax characters in the amount of their tax value. In simplified terms, the process can be imagined like buying stamps: the value of the “tax stamps” purchased corresponds to the tobacco tax.

Period tax rate January 1, 2022 to December 31, 2023 0.16 euros per milliliter

January 1, 2024 to December 31, 2024 0.20 euros per milliliter

January 1, 2025 to December 31, 2025 0.26 euros per milliliter

from January 1, 2026 0.32 euros per milliliter

- User Center

- Tracking Order

- Register

- My Orders

- My Account

- Terms & Conditions

- FAQ

- Payment & Shipping

- Payment Methods

- Shipping & Delivery